Subtitles & vocabulary

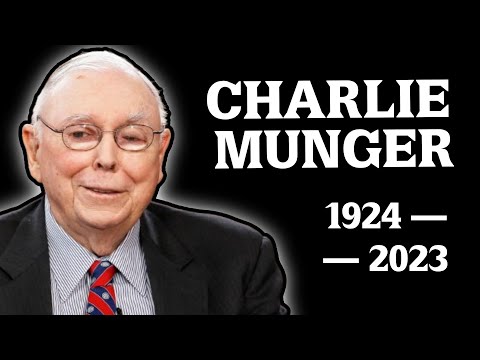

RIP Charlie Munger — His Greatest Ever Moments

00

林宜悉 posted on 2023/09/27Save

Video vocabulary

stuff

US /stʌf/

・

UK /stʌf/

- Uncountable Noun

- Generic description for things, materials, objects

- Transitive Verb

- To push material inside something, with force

B1

More sort

US /sɔrt/

・

UK /sɔ:t/

- Transitive Verb

- To organize things by putting them into groups

- To deal with things in an organized way

- Noun

- Group or class of similar things or people

A1TOEIC

More figure

US /ˈfɪɡjɚ/

・

UK /ˈfiɡə/

- Verb (Transitive/Intransitive)

- To appear in a game, play or event

- To calculate how much something will cost

- Noun

- Your body shape

- Numbers in a calculation

A1TOEIC

More enormous

US /ɪˈnɔrməs/

・

UK /iˈnɔ:məs/

- Adjective

- Huge; very big; very important

- Very great in size, amount, or degree.

A2

More Use Energy

Unlock Vocabulary

Unlock pronunciation, explanations, and filters