Subtitles & vocabulary

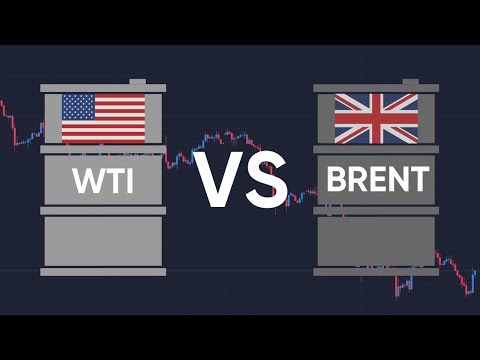

Crude Oil Prices Explained - WTI vs Brent

00

林宜悉 posted on 2020/03/10Save

Video vocabulary

sort

US /sɔrt/

・

UK /sɔ:t/

- Transitive Verb

- To organize things by putting them into groups

- To deal with things in an organized way

- Noun

- Group or class of similar things or people

A1TOEIC

More incredibly

US /ɪnˈkrɛdəblɪ/

・

UK /ɪnˈkredəbli/

- Adverb

- To a great degree; very; amazingly

- Extremely; so much so it is hard to believe

A2

More massive

US /ˈmæsɪv/

・

UK /ˈmæsɪv/

- Adjective

- Very big; large; too big

- Large or imposing in scale or scope.

B1

More significant

US /sɪɡˈnɪfɪkənt/

・

UK /sɪgˈnɪfɪkənt/

- Adjective

- Large enough to be noticed or have an effect

- Having meaning; important; noticeable

A2TOEIC

More Use Energy

Unlock Vocabulary

Unlock pronunciation, explanations, and filters