Subtitles & vocabulary

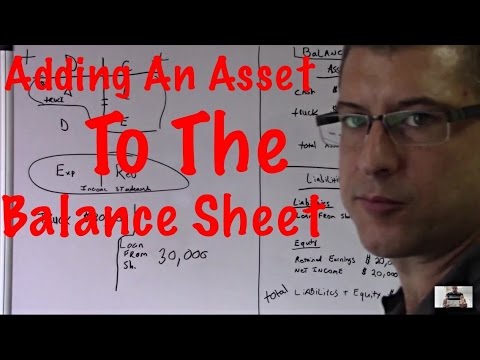

Accounting for beginners #6 / Putting an Asset on the Balance Sheet

00

陳虹如 posted on 2017/06/23Save

Video vocabulary

scenario

US /səˈner.i.oʊ/

・

UK /sɪˈnɑː.ri.əʊ/

- Noun

- An imagined sequence of events in a plan/project

B1

More positive

US /ˈpɑzɪtɪv/

・

UK /ˈpɒzətɪv/

- Adjective

- Showing agreement or support for something

- Being sure about something; knowing the truth

- Noun

- A photograph in which light areas are light and dark areas are dark

A2

More mess

US /mɛs/

・

UK /mes/

- Noun (Countable/Uncountable)

- Something that is untidy, dirty or unclean

- A difficult or confused situation.

- Transitive Verb

- To make something untidy or dirty

A2

More revenue

US /ˈrevənju/

・

UK /'revənju:/

- Noun (Countable/Uncountable)

- Money that is made by or paid to a business

- Money a government collects from its people

A2TOEIC

More Use Energy

Unlock Vocabulary

Unlock pronunciation, explanations, and filters