Subtitles & vocabulary

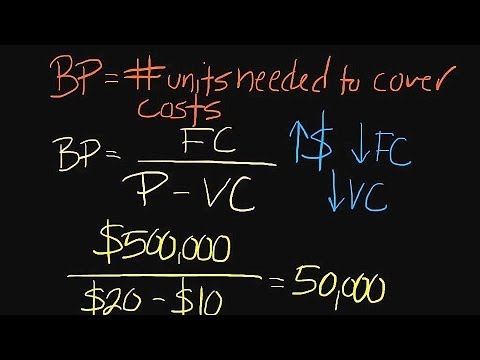

Episode 59: How to Conduct a Breakeven Analysis

00

陳虹如 posted on 2017/06/23Save

Video vocabulary

ultimately

US /ˈʌltəmɪtli/

・

UK /ˈʌltɪmətli/

- Adverb

- Done or considered as the final and most important

- Fundamentally; at the most basic level.

B1TOEIC

More relevant

US /ˈrɛləvənt/

・

UK /ˈreləvənt/

- Adjective

- Having an effect on an issue; related or current

A2TOEIC

More essentially

US /ɪˈsenʃəli/

・

UK /ɪˈsenʃəli/

- Adverb

- Basically; (said when stating the basic facts)

- Used to emphasize the basic truth or fact of a situation.

A2

More significant

US /sɪɡˈnɪfɪkənt/

・

UK /sɪgˈnɪfɪkənt/

- Adjective

- Large enough to be noticed or have an effect

- Having meaning; important; noticeable

A2TOEIC

More Use Energy

Unlock Vocabulary

Unlock pronunciation, explanations, and filters