Subtitles & vocabulary

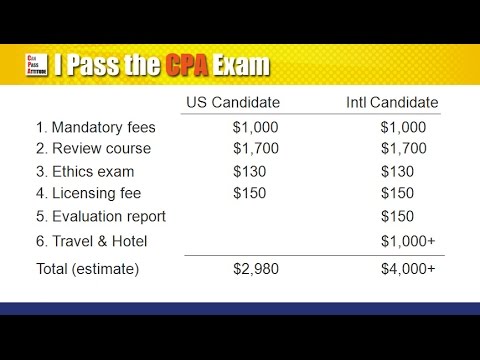

CPA Exam Fees Estimation and Breakdown

00

陳虹如 posted on 2017/06/23Save

Video vocabulary

equivalent

US /ɪˈkwɪvələnt/

・

UK /ɪˈkwɪvələnt/

- Adjective

- Equal to something in value, use or meaning

- Having the same meaning or significance.

- Noun

- Thing like another in quality, quantity or degree

B1TOEIC

More process

US /ˈprɑsˌɛs, ˈproˌsɛs/

・

UK /prə'ses/

- Transitive Verb

- To organize and use data in a computer

- To deal with official forms in the way required

- Noun (Countable/Uncountable)

- Dealing with official forms in the way required

- Set of changes that occur slowly and naturally

A2TOEIC

More situation

US /ˌsɪtʃuˈeʃən/

・

UK /ˌsɪtʃuˈeɪʃn/

- Noun (Countable/Uncountable)

- Place, position or area that something is in

- An unexpected problem or difficulty

A1TOEIC

More recommend

US /ˌrɛkəˈmɛnd/

・

UK /ˌrekə'mend/

- Transitive Verb

- To advise or suggest that someone do something

- To endorse or support something publicly.

A2TOEIC

More Use Energy

Unlock Vocabulary

Unlock pronunciation, explanations, and filters