Subtitles & vocabulary

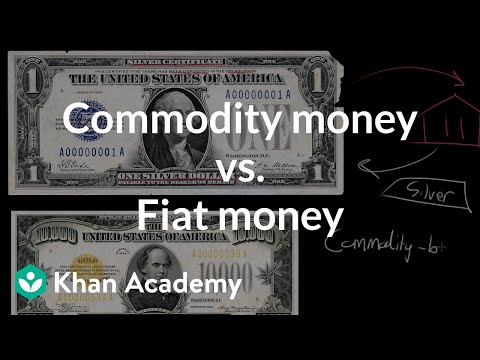

Commodity money vs. Fiat money

00

Chia-Yin Huang posted on 2016/11/04Save

Video vocabulary

money

US /ˈmʌni/

・

UK /'mʌnɪ/

- Noun (Countable/Uncountable)

- Coins or notes we use to pay for things

A1TOEIC

More back

US /bæk/

・

UK /bæk/

- Adjective

- Farthest from the front e.g. in a classroom

- Transitive Verb

- To bet money on something

- To support and encourage someone or some cause

A1TOEIC

More dollar

US /ˈdɑ:lə(r)/

・

UK /ˈdɒlə(r)/

- Countable Noun

- A basic unit of money equal to 100 cent

- A dollar is a small amount of money

- Uncountable Noun

- Informal term for money or wealth.

A1

More kind

US /kaɪnd/

・

UK /kaɪnd/

- Adjective

- In a caring and helpful manner

- Countable Noun

- One type of thing

A1TOEIC

More Use Energy

Unlock Vocabulary

Unlock pronunciation, explanations, and filters