Subtitles & vocabulary

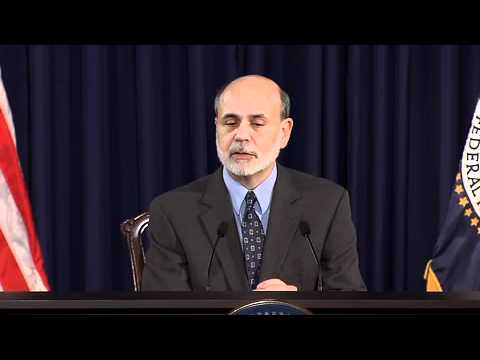

Press Conference with Chairman of the FOMC, Ben S. Bernanke

00

稲葉白兎 posted on 2014/10/25Save

Video vocabulary

long

US /lɔŋ, lɑŋ/

・

UK /lɒŋ/

- Proper Noun

- Person's name

- Adjective

- Large distance from one end to the other

- Having many parts, e.g. a book with many chapters

A1

More interest

US /ˈɪntrɪst, -tərɪst, -ˌtrɛst/

・

UK /'ɪntrəst/

- Noun (Countable/Uncountable)

- Best or most advantageous thing for someone

- Activity or subject one enjoys doing or learning

- Transitive Verb

- To make someone want to know about something

- To persuade to do, become involved with something

A1TOEIC

More rate

US /ret/

・

UK /reɪt/

- Transitive Verb

- To assess something or consider its qualities

- Noun (Countable/Uncountable)

- Current price or cost of something

- Speed or frequency of events over time

A1TOEIC

More financial

US /faɪˈnænʃ(ə)l/

・

UK /faɪˈnænʃl/

- Adjective

- Involving money

- Relating to investments.

- Countable Noun

- A person who provides advice on financial matters.

A2TOEIC

More Use Energy

Unlock Vocabulary

Unlock pronunciation, explanations, and filters